A lot has changed over 2020 - especially the gaming market. But what are these changes? And what do you need to know? We cover just that.

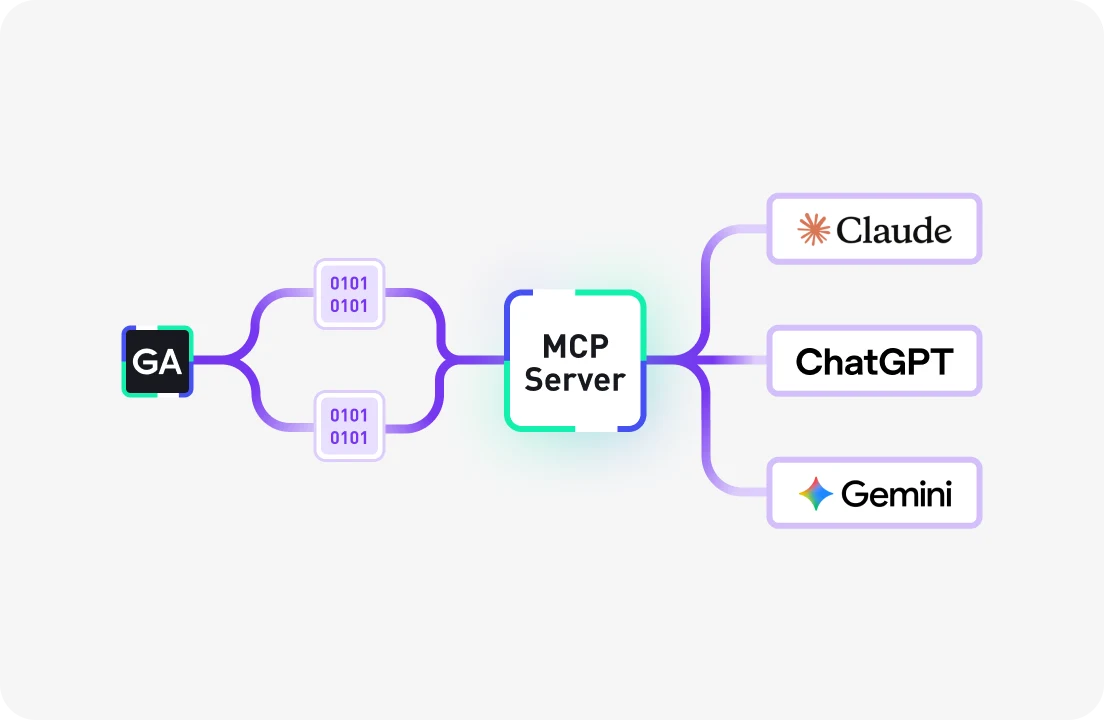

2020’s been a year like no other. Casual and hypercasual gaming has fared better than most industries – overall playtime has been consistently up by around 15% on previous years. But when all of our usual social norms have been upended by global lockdowns, how do we make sense of the player metrics we rely on?I recently hosted a webinar on this topic. Using Benchmarks+ from GameAnalytics, I pulled some of the most telling player data from the first eight months of 2020. I dived into the key metrics like retention, session lengths, and playtime. And I did a deep dive specifically on hypercasual – comparing the different app stores and regions.Here’s a summary of the trends I found that will be most useful for developers to understand.

The differences between iOS and Android

It’s important not to assume metrics should be the same across both platforms. They rarely will be. There are fundamental differences that show up in the data.

Android has lower retention rates across all casual and hyper-casual games

Day-seven retention is generally the ‘golden metric’ of player engagement. It’s a highly important stat to consider when you’re testing your game. But it differs across platforms.The top iOS games get around 25% day-seven retention. But on Android, the top games get roughly 21%. Android’s figure also seems more affected by the Covid-19 pandemic, with a 1.5% to 2% drop. iOS had a smaller drop, and recovered more quickly.There are lots of reasons why the two platforms differ so much. There are far more Android devices than there are iOS devices. And Android devices have higher error rates. This is most pronounced in China, where there are multiple Android app stores.

The retention gap is even bigger when we look at hypercasual games specifically

The top hypercasual games on iOS have about 21% day-seven retention. For Android, it’s just 14%. So the top iOS games get 50% more players returning after seven days.iOS Day 7 Retention

Android Day 7 Retention

That’s a big difference. So when you compare your metrics across the two platforms, you can’t judge them the same way. Looking at LTV (the average ‘lifetime value’ of a player), rather than retention, will give you a clearer picture of your game’s performance.

Surprisingly, Android players show higher playtime

That’s right – Android players play fewer days, but log more playtime overall. ASL (average session length) on iOS is pretty stable, and only decreases late in the holiday season. Android’s ASL started the year about 20% higher. Its seasonal drops are generally bigger, but it’s still solidly ahead of iOS in 2020. Android players also post more individual play sessions.It’s hard to know why this happens. Maybe Android players play more ‘snackable’ games, or maybe the higher error rate means they just have to restart more.

With all these contradictory trends, LTV analysis is essential

Looking at a single engagement stat isn’t enough. If you focus only on retention, playtime, or session count, these differences between platforms will always skew your results.That’s why it’s better to focus on LTV. Observing your ad revenue and IAP revenue in the same place will help you optimize for monetization, rather than engagement.

The differences between regions

As if the differences between platforms weren’t enough to factor in, we also see variability between different international markets.

North America has a more variable ASL than Europe

Hypercasual games are still very popular in North America and Europe. But the ways people play are very different.ASL in North America has gone up and down a lot in 2020. And there’s a clear pattern that tracks with the Covid-19 lockdowns. In Europe, it’s more stable – smaller dips and smaller spikes, with much less correlation with lockdowns. The ALS for top games in North America is between 10 and 30 minutes, whereas it’s slightly higher in Europe – between 15 and 35 minutes.While Europe generally has lower eCPM (cost per 1,000 ad impressions), it has lower CPI (cost per install) and higher session lengths.

The Asian market is behind for now, but it’s growing fast

The ASL in Asian countries has been about 30% lower than in North America and Europe in 2020. The top games get roughly 10 to 25 minutes.There’s a clear Covid pattern too. China, for example, locked down earlier than most countries and opened up earlier too – we see this reflected in the average ASL.We’re expecting the Chinese market to keep growing. The Chinese tech giant TenCent recently took a minority stake in prolific hypercasual developer Voodoo (the makers of Aqua Park). And publishers are getting better at localizing games for the complicated Chinese market.

What we've learned in 2020 and what we predict

Here are the three main takeaway from the trends we’ve looked at:

The usual trends for player behavior don’t apply in 2020

The Covid-19 lockdowns have their different timings have caused sharper spikes and dips in playtime and retention, compared to previous years. And long-standing trends like lower playtimes on weekdays have been largely absent so far in 2020. So be wary about comparing this year’s metrics to that of previous years.

When metrics vary, focus on LTV

Testing on Android and iOS will give you very different results – often in unexpected and contradictory ways. So focusing on retention will make it difficult to properly assess how your prototypes are performing. To see through the fog of platform differences, focus on LTV.

Asia is the next growth market

We expect a new hyper-casual growth wave in Asia to arrive soon – particularly in China. More publishers are heading into this market. And with platforms like WeChat and the already enormous gaming market, all the infrastructure is already in place for an explosion of hypercasual games.

With the right tools, you can track these trends and spot the opportunities

The complexity of the trends we’ve discussed can be an obstacle or an opportunity. It just depends on how well you can measure and analyze the data.

Get these insights on the go

All the metrics we used for our webinar came from Benchmarks+. And you can already get a 20% discount on the full service with the discount code ‘insights2020’.

You can now track your ad revenue on GameAnalytics

We’ve partnered up with MoPub to bring you ad revenue data, so you can track that all-important LTV. Get started on our new Ads Dashboard for free.

And boost your optimization with A/B testing

You can A/B test ads, assets, and features in your game and use our remote configs to set them live. Get unlimited access until 2021.