· 4 min read

A Behavioural Analysis of Chinese Mobile Gamers

Chay Hunter

EVP, Marketing at GameAnalytics

If you’ve read our helpful guide to launching mobile games in China, you’ll know that there are a number of stylistic and cultural differences between the kinds of games that Chinese and Western gamers choose to play. But how about the differences in when and how they play the games themselves?

With that in mind, we’ve picked out five insights that we think will help Western game developers better understand and appeal to audiences in the East.

1. Fewer Chinese gamers spend money…

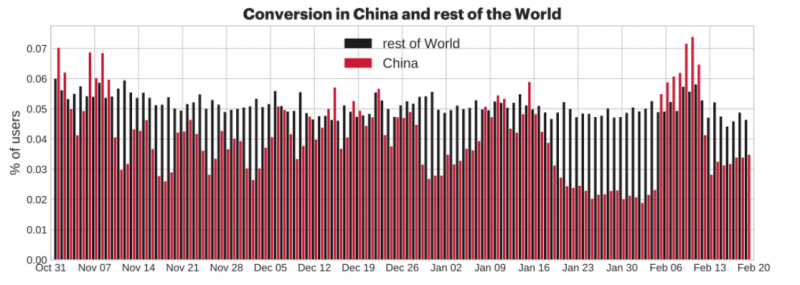

Just as in the West, Chinese mobile gamers mostly play titles that are free to download, but which monetize through IAP or advertising. When we compared the proportion of free-to-play gamers that converted to paying players, Chinese players were around 20% less likely to convert than players in the rest of the world.

However, the big swings between high and low conversion rates suggest that Chinese players are more volatile and influenced by factors like days of the week. This suggests that they may convert at much higher rates during holidays or other events than a typical day; in contrast, gamers in the rest of the world were more predictable. Also, with over 700 million smartphone users in China, there is a much bigger player base to target your game at (success in China is essentially a way to double your DAU), so this variability may not be a major problem.

2. … but they spend money more often

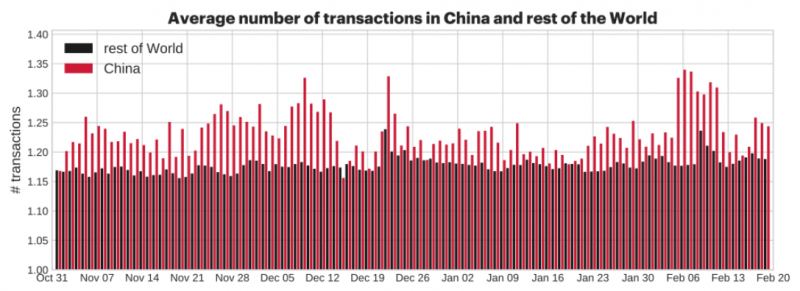

Even though our data shows that Chinese gamers spend less on average, our research found that the number of transactions made by Chinese gamers is slightly, but consistently, higher than the rest of the world.

We already know that slightly fewer gamers convert to become paying players, and we also know from the data that the average transaction amount is slightly lower. But it would appear that the higher frequency of transactions means that Chinese gamers prefer games that offer smaller, but more frequent, in-app payments.

3. Chinese gamers play fewer sessions, but for longer

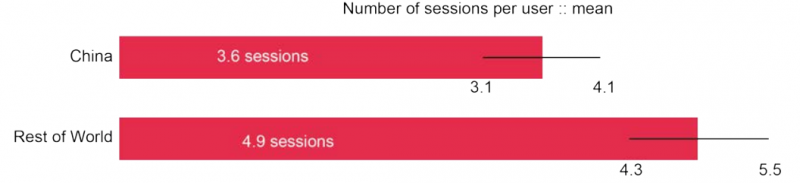

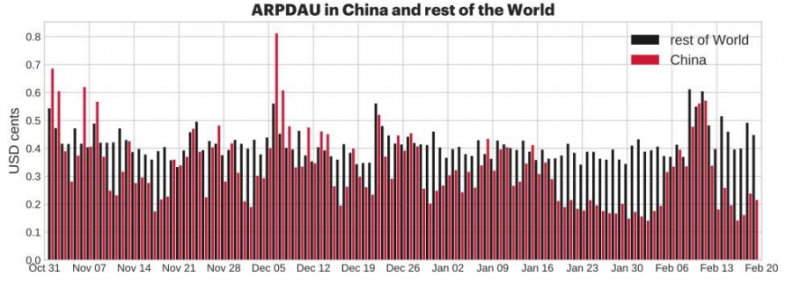

Chinese gamers play on average one less session per day than their rest-of-the-world equivalents, with 3.6 sessions per player per day compared to 4.9 in the rest of the world. However, Chinese players spend 48% more time per session, which means that for free to play games with ad-based monetization, higher session times provide more opportunities for players to view and interact with ads.

4. Chinese gamers spend more

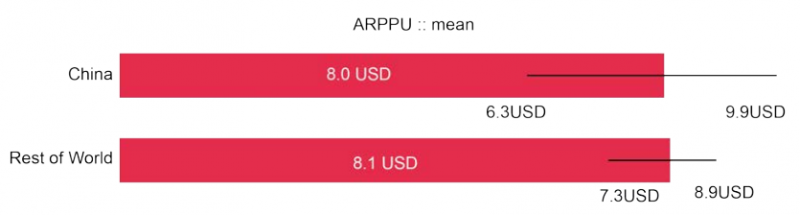

So far we’ve seen that a lower proportion of people that play free to play games go on to spend money inside the game, but when they do, they do so more frequently. When it comes to the amount of money a paying player will spend – also called ARPPU – Chinese gamers spend pretty much the same as everyone else, with the average of both groups around $8.

However, the big difference is in those players that spend more than the average. If we just compare this group, we find that more players from China spent higher than the average ARPPU than the rest of the world.

This suggests that targeting this higher spending group may offer a good ROI, both because of the number of these higher spenders, and the fact that tended to spend 11% more than high spenders from elsewhere.

5. Chinese gamers like to try out new games as well as play old favourites

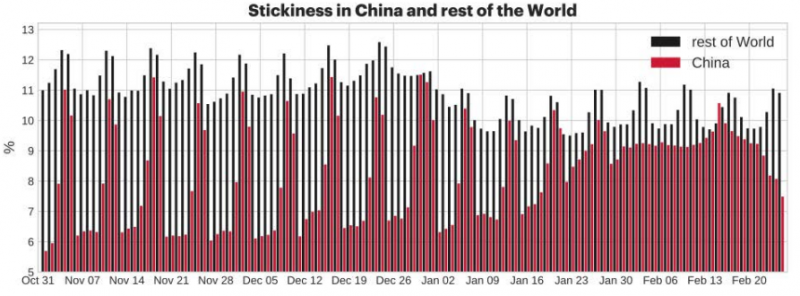

Stickiness provides a measurement on how engaged players are. As you can see in these charts, only 6-7% of gamers in China typically returned to the same game within 30 days. However, as the weekend got closer this rate increased to almost 11% – suggesting that they have a few trusted games they go back to on weekends, but tend to experiment with many new games the rest of the time.

This creates interesting opportunities to test game design improvements on new players, until their behaviour shifts and the game becomes a regular destination for them.

Download the full report!

This is a condensed version of our research. The full analysis is a comprehensive 62-page report, produced in collaboration with Mobvista. It contains first-hand data and tonnes of actionable tips to release successful mobile games in China.

Download the full report for free here: Looking East: How to launch mobile games in China